Forex Trading Vs Gambling

- Forex Trading Vs Gambling Real Money

- Forex Trading Vs Gambling Winnings

- Forex Trading Vs Sports Betting

- Forex Trading Vs Gambling Losses

Forex Trading Pros: Back testing a strategy is very easy – Luckily we have a crazy amount of data from the currency markets.They have been around for year and it is very easy to get information about previous prices, structure highs, news and everything in-between.

This site is designed to give you the best information when it comes to trading currencies. But although forex trading makes up 60% of my personal income, the other 40% comes from other investing. This includes stocks and shares but also a growing part comes from sports betting, we even have a separate website that talks about this in detail called Ghost Betting Tips.

When I tell people I have £50,000 across a number of sports betting accounts their first reaction is pure shock. Usually followed by the “How can you risk that much money?” The truth? If you keep correct bankroll management, all investing is easy over the long term. Whether that be stocks and shares, forex, sports or anything else. So today I’m going to run through some of my personal opinions on the pros and cons of forex vs sports. I even have a twitter dedicated to only this.

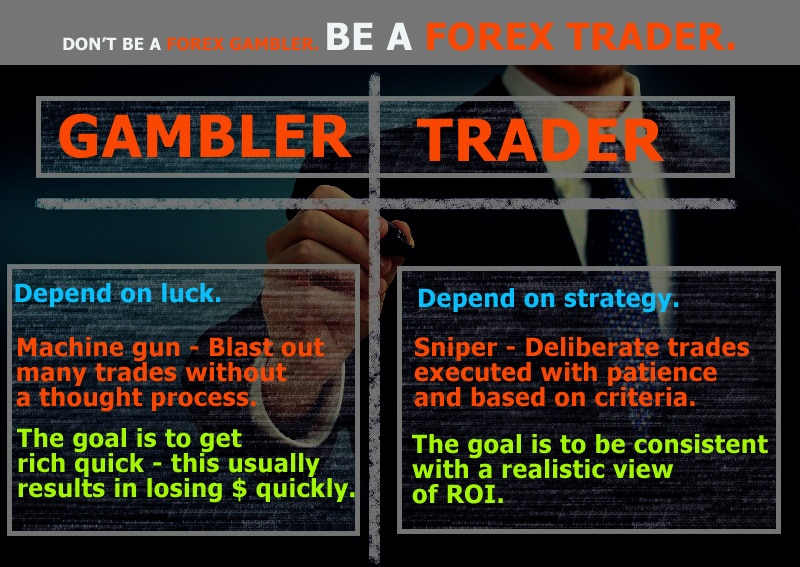

- The truth is simple. Forex trade is not gambling, but most folks actually treat and exercise it as gambling. If we approach forex trading with no implementation of money management and risk management it is pure gambling, and if we approach forex.

- Tell me you didn't push the play button? Basic traits of a gambling Forex trader:. Has no trading edge or effective trading strategy. Doesn’t have or use a trading plan. Doesn’t have or use a trading journal to keep records. Pays little to no attention to risk management. Spends most of their time focused on profits and rewards. Often feels intense emotional ups and downs.

Table of Contents

Forex Trading Pros:

Back testing a strategy is very easy – Luckily we have a crazy amount of data from the currency markets. They have been around for year and it is very easy to get information about previous prices, structure highs, news and everything in-between. As a result if you come up with a trading strategy. It is very easy to see if you would have made a profit if you traded this in the past. This means you can essentially predict the future (by using the results of the past.)

Limits – There are very few limits to trading forex. You simply have to set up a trading account and then get going. There aren’t any limits to the maximum you can make on a trade. If you are following correct forex trading principles then even if you have 100 million in your trading account you should still only be trading 1 million per trade and hence the currencies won’t fluctuate just due to your investment.

Forex Trading Cons:

Tax – You have to pay tax on all your profits. Like a business this means you have to aquire the funds to start

Starting Capital – Probably the biggest issue to trading forex. As the spreads and pip movements are so small you will need a relatively large bankroll to become a profitable trader. Even if you get leverage at 10/1 you will still need a starting capital of £10,000+. This is one of the reasons I’m so against demo trading accounts. But that’s a rant so I won’t get started!

Strategies – Building the perfect trading strategy takes a lot of time. Back testing through previous years also takes a very long time. The issue with the strategy/system element is traders move around and become too aggressive with their trading strategies. When they fail or blow all their bankroll, suddenly its the strategies fault and not the fact you were putting 15% of your bankroll on every trade… Bankroll management is king.

Sports Betting Pros:

No TAX – Wow this is a big one for me. In the UK you don’t pay tax on sports betting winnings. I know in the US and other countries this isn’t the case. But if you are seriously making a lot of money then you might want to consider one of the tax havens, that goes for any investment earnings. Paying less tax is something I have been looking into for years. Originally having a business and paying 20-50% tax on earnings was hard enough. Nowadays with investing its down around 18%. But with sports betting you pay 0% (in the UK at least).

More hands off – It’s a lot less time intensive than forex trading. Sports betting is more geared around value for specific odds. However you calculate that value, whether you have a hunch (not recommended) or do statistical analysis and back-test results based on previous data (recommended). Once a model is created this is very hands off. You can simply bet where you see value and leave the results to play out.

“Inside Information” – In other types of trading inside information is illegal. People go to prison for decades for trading with inside information. It is a crime. BUT when it comes to sports betting, it seems the more you know the better. Why punish someone when all they have done is found out a start player isn’t playing before the bookies adjust their prices? Or that there is going to be a storm in the middle of a football match, making it much more likely that less points are scored and hence the under total points becomes the best play. But the most important element is that individuals “tipsters” (I hate that word) can give you plays in return for cash. Now you have to be incredibly careful with these people! BUT if you follow the most reliable tipsters you can make 500% ROI per year and that’s no exaggeration!

Sports Betting Cons:

Regulation – There are lots of regulations around where you can place bets. For example in the UK I cannot use Pinnacle or a number of other large sportsbooks. In the USA as previously mentioned I believe you have to pay tax on your winnings too and in some states sports betting is straight up illegal, so check the regulations before you get started.

Low Limits & The dreaded “exceeds maximum bet” – Unlike forex trading, when you make a bet/trade you are making it with the bookie itself. This means that as your bankroll grows you are more likely to be flagged as a very good sports trader. This means you are more likely to have limits on how much you can bet per event. This depends on the size of the event. For example the maximum bet on the superbowl is over 1 million for almost all sportsbooks. But the maximum bet for a small soccer game in league 2 would probably only be £500 in most places. Bigger events have higher limits as the lines are more carefully calculated, meaning the bookies have a higher degree of confidence and hence will accept larger bets. If you are with a sportsbook or bookie that says “exceeds maximum bet” for a specific result then it is probably time to move. This means they are on to your smart betting and don’t want you to take any money from them!

Conclusion

Personally I love both sports and forex trading. I will never stop one for another and I will be doing them both for years and years to come. But spreading “risk” and having some diversity is great. Back-testing sports betting strategies to see how much you would have made in a season is very similar to back-testing a forex trading strategy to see if your strategy is profitable. My biggest piece of advice would be don’t just rush into any type of trading. Build a strategy. Build your bankroll. Decide your bankroll management strategy. Good luck. Remember to check out our beginner ultimate guide and our free ebook for your forex trading introduction.

Tom is the owner of Elite Forex Trading. A website that provides beginner tips, trainings, reviews and strategies to help newbies get started making money in the forex markets.

(Last Updated On: June 30, 2018)This site is designed to give you the best information when it comes to trading currencies. But although forex trading makes up 60% of my personal income, the other 40% comes from other investing. This includes stocks and shares but also a growing part comes from sports betting, we even have a separate website that talks about this in detail called Ghost Betting Tips.

When I tell people I have £50,000 across a number of sports betting accounts their first reaction is pure shock. Usually followed by the “How can you risk that much money?” The truth? If you keep correct bankroll management, all investing is easy over the long term. Whether that be stocks and shares, forex, sports or anything else. So today I’m going to run through some of my personal opinions on the pros and cons of forex vs sports. I even have a twitter dedicated to only this.

Table of Contents

Forex Trading Pros:

Back testing a strategy is very easy – Luckily we have a crazy amount of data from the currency markets. They have been around for year and it is very easy to get information about previous prices, structure highs, news and everything in-between. As a result if you come up with a trading strategy. It is very easy to see if you would have made a profit if you traded this in the past. This means you can essentially predict the future (by using the results of the past.)

Limits – There are very few limits to trading forex. You simply have to set up a trading account and then get going. There aren’t any limits to the maximum you can make on a trade. If you are following correct forex trading principles then even if you have 100 million in your trading account you should still only be trading 1 million per trade and hence the currencies won’t fluctuate just due to your investment.

Forex Trading Cons:

Tax – You have to pay tax on all your profits. Like a business this means you have to aquire the funds to start

Starting Capital – Probably the biggest issue to trading forex. As the spreads and pip movements are so small you will need a relatively large bankroll to become a profitable trader. Even if you get leverage at 10/1 you will still need a starting capital of £10,000+. This is one of the reasons I’m so against demo trading accounts. But that’s a rant so I won’t get started!

Strategies – Building the perfect trading strategy takes a lot of time. Back testing through previous years also takes a very long time. The issue with the strategy/system element is traders move around and become too aggressive with their trading strategies. When they fail or blow all their bankroll, suddenly its the strategies fault and not the fact you were putting 15% of your bankroll on every trade… Bankroll management is king.

Sports Betting Pros:

Forex Trading Vs Gambling Real Money

No TAX – Wow this is a big one for me. In the UK you don’t pay tax on sports betting winnings. I know in the US and other countries this isn’t the case. But if you are seriously making a lot of money then you might want to consider one of the tax havens, that goes for any investment earnings. Paying less tax is something I have been looking into for years. Originally having a business and paying 20-50% tax on earnings was hard enough. Nowadays with investing its down around 18%. But with sports betting you pay 0% (in the UK at least).

More hands off – It’s a lot less time intensive than forex trading. Sports betting is more geared around value for specific odds. However you calculate that value, whether you have a hunch (not recommended) or do statistical analysis and back-test results based on previous data (recommended). Once a model is created this is very hands off. You can simply bet where you see value and leave the results to play out.

“Inside Information” – In other types of trading inside information is illegal. People go to prison for decades for trading with inside information. It is a crime. BUT when it comes to sports betting, it seems the more you know the better. Why punish someone when all they have done is found out a start player isn’t playing before the bookies adjust their prices? Or that there is going to be a storm in the middle of a football match, making it much more likely that less points are scored and hence the under total points becomes the best play. But the most important element is that individuals “tipsters” (I hate that word) can give you plays in return for cash. Now you have to be incredibly careful with these people! BUT if you follow the most reliable tipsters you can make 500% ROI per year and that’s no exaggeration!

Sports Betting Cons:

Regulation – There are lots of regulations around where you can place bets. For example in the UK I cannot use Pinnacle or a number of other large sportsbooks. In the USA as previously mentioned I believe you have to pay tax on your winnings too and in some states sports betting is straight up illegal, so check the regulations before you get started.

Forex Trading Vs Gambling Winnings

Forex Trading Vs Sports Betting

Low Limits & The dreaded “exceeds maximum bet” – Unlike forex trading, when you make a bet/trade you are making it with the bookie itself. This means that as your bankroll grows you are more likely to be flagged as a very good sports trader. This means you are more likely to have limits on how much you can bet per event. This depends on the size of the event. For example the maximum bet on the superbowl is over 1 million for almost all sportsbooks. But the maximum bet for a small soccer game in league 2 would probably only be £500 in most places. Bigger events have higher limits as the lines are more carefully calculated, meaning the bookies have a higher degree of confidence and hence will accept larger bets. If you are with a sportsbook or bookie that says “exceeds maximum bet” for a specific result then it is probably time to move. This means they are on to your smart betting and don’t want you to take any money from them!

Forex Trading Vs Gambling Losses

Conclusion

Personally I love both sports and forex trading. I will never stop one for another and I will be doing them both for years and years to come. But spreading “risk” and having some diversity is great. Back-testing sports betting strategies to see how much you would have made in a season is very similar to back-testing a forex trading strategy to see if your strategy is profitable. My biggest piece of advice would be don’t just rush into any type of trading. Build a strategy. Build your bankroll. Decide your bankroll management strategy. Good luck. Remember to check out our beginner ultimate guide and our free ebook for your forex trading introduction.

Tom is the owner of Elite Forex Trading. A website that provides beginner tips, trainings, reviews and strategies to help newbies get started making money in the forex markets.